⚡Crypto Alert : Altcoins are up 28% in just last month! Unlock gains and start trading now - Click Here

FOREX BROKERS BY FXLEADERS.COM

Before going over our updated list of forex brokers for 2025, here are a few steps to help you choose the right broker for you.

In the last decade, online trading has become increasingly popular. It's a relatively new industry, but the number of service providers or brokers are considerable. Most brokerages offer great services, but traders must make sure the broker they chose offers what they need.

MORE FOREX BROKERS

Please note that the above list has been compiled in paid partnership with select forex brokers around the world, and is not a comprehensive one. FX Leaders offers reviews and information only on established forex brokers that are licensed and regulated by the leading financial regulation authorities.

WORLD'S BEST FOREX BROKERS REVIEW

- Our team of analysts reviews and recommends the world's top online forex brokers

- Open a trading account in 2024 with the right broker for you

- Enjoy our complete guide to choosing a broker

The Great Importance of Genuine Broker Reviews

Trading with an unreliable broker is like entering a battle without any armor. When traders do this, they expose themselves to unpredictable risks, which is unnecessary. It’s really important to do your homework before choosing a suitable brokerage. At FX Leaders we pride ourselves on our ability to provide the most accurate and unbiased broker reviews possible. As experts in the field, we know that a high-quality broker is an essential component of your trading success and capital preservation. FX Leaders have taken much time and effort to compile the indispensable Definitive Guide to Forex Brokers.Interested in Forex and don't know how to choose between the hundreds of Forex brokers out there? Have no fear!

The Definitive Guide to Forex Brokers - Highlights and what they entail

Learn more about the following broker topics.- Security and Regulations – How to check if the broker is registered and licensed in your area.

- Broker Types – Pick the best type of broker to suit your trading style.

- Trading Platforms – Most brokerages offer trading platforms like Metatrader 4 or Metatrader 5 for free, but there are plenty of brokers that offer their own customized platforms. Conduct a thorough examination to see what's best for you.

- Spreads and Commissions – Find out what exact fees you are being charged and for which services. If the detailed information is not found on the website, call and ask customer support about spreads and other fees.

- Social Brokers - Learn how to use social trading and copy trading platforms.

- Customer Support – Understand why Customer support is imperative when choosing a broker.

- Broker Extras – Bonuses, promotions, rebates, webinars, etc.

Security and Regulations

To protect your hard-earned money, trade only with forex brokers you can trust. When conducting your search, avoid unregulated brokers at all cost and investigate under which authority they are regulated. Be sure to confirm that their license is valid. The regulating authorities enforce rules on their affiliated forex brokers that regulate aspects such as the amount of leverage they may offer to their clients and which measures they should take to protect their client’s deposits and profits from trading. Make sure the broker you choose meets all of the forex broker regulations.Forex Broker Types

Are you aware that there are different types of brokers? Not all platforms execute their clients’ trades in the same way. Functions like the spread, commissions, rollover fees, liquidity, re-quotes, slippage, the reliability of execution, and many other factors, are influenced by the type of broker you use.Three main types of forex brokers:

- Market Makers - deals don't take place in the interbank market, so they are able to set their own prices. With these brokers, it's important to track the spreads.

- ECN or Electronic Communications Networks - these connect traders in the interbank system and create the link between buyers and sellers.

- STP or Straight Through Processing Brokers - they don't have a dealing desk, and trade only within the interbank system. Prices are equal to interbank rates and only smaller trades can be accommodated.

Trading Platforms

Trading platforms are also an important aspect to consider when choosing a broker. The most popular platforms are the Metatrader 4 or Metatrader 5 platforms, almost all brokers offer one or the other. However, if you want more options, there are plenty of brokers who offer their own customized trading platforms. Some of these platforms are confusing to a first-time user but some are surprisingly good. For a thorough list see our new featured forex brokers list above and read about the different trading platforms. You might like: 10 Best Forex Brokers in South AfricaPossible Broker Fees

Costs are very important to every trader and as a result, spreads must be as small as possible in order for a forex broker to be considered a good choice, especially to those who tend to trade short-term signals.

In addition, there are other fees, such as deposit/withdrawal fees, dormant account charges, etc. Pay attention to dormant account penalties as well. Make sure to check all types of fees before opening an account with any broker.

Broker Customer Support

Another critical aspect to consider is the broker's customer support. A helpful customer support system can keep a small issue from turning into nightmares. Additional features to check include bonuses, rebates, promotions, online and in-person training and webinars.

It's important to check which of these services appeal to you, depending on your trading methods and level, in order to find the broker that will fully fit your needs. Your trading style is another way that will help determine whether a broker is right for you. For example, if you focus on using the scalping trading strategy and your broker does not support this strategy, you will not be able to trade with them.

Since each firm has their own style, we advise opening a demo account to test your strategy and check for a good fit before choosing a broker to invest with.

Spread and Commission

A forex broker’s spread and commission structure are an extremely important consideration when doing a comparison. First of all, a wider spread makes it more difficult to execute trades profitably because the price needs to cover a greater distance to your take profit. It also increases your risk of losing trades because the price is automatically closer to your stop loss. Besides these trade hurdles, higher commissions, wider spreads, expensive rollover fees, and additional fees will eat away a substantial part of your forex trading profits in the long run. Make sure you do your homework on this topic properly and find out more about forex broker spreads and commissions.Social Forex Brokers

For investors who don’t like to do all the forex trading and forex market analysis themselves, there is an exciting way to access this massive market (and a wide range of other markets) in a very efficient way. With the help of social trading and copy trading brokers, the amazing concept of copying profitable traders is made incredibly simple and easy on their platforms. There is another side to social trading - becoming a leader yourself. If you have what it takes to trade the markets responsibly and profitably, you can earn money on their platforms as a ‘popular investor’. Your trades will be copied to the investors’ accounts who choose to copy you. The social forex broker will then pay you a commission according to the number of traders copying you, and/or the amount of money you manage in this way. Here is a great way to learn more about social forex brokers.Tips from our Expert Trader

How to evaluate your broker’s performance

Personally, I trade with a couple of different brokers because of fund management requirements. A few years ago, I tried to place two market orders with one of these brokers, on the EUR/JPY currency pair, which weren’t executed. When I contacted my personal account manager, he said he would have the issue investigated and get back to me. Trades which weren’t executed would have made a profit and the broker calculated how much the profit would have been by looking at where my take profit order was supposed to be. The broker credited my trading account with this amount and said they were glad to perform a one-off compensation for the ‘loss of potential profits’. It was a one-off deal because they do not usually compensate for the loss of potential gains when it comes to order execution errors. The generosity of this broker amazed me, as the authorized manager went out of his way to keep me happy. I didn’t expect they would compensate me for loss of potential profits.How to evaluate your broker's customer service

Customer service is really important when you encounter serious problems with the platform you’re trading on. When you’re in such a situation, the speed at which the technical team solves the issue can determine whether you lose or make money. There are a few ways you can test the reliability of your broker with regards to customer service. For example, I had a charting issue with the same outstanding forex broker that was so generous to reimburse me for their execution errors. The issue was that the charts didn’t load when I launched the platform. Now to me, this is a massive problem. I don’t know about you, but I can’t trade without seeing charts in front of me. This was a really difficult problem for them to solve, but they got it right in the end. Problems like this can easily rob you of a profitable day’s worth of trading. When things like this happen, the degree of support you get from your broker is absolutely critical.How to gauge your broker’s responsiveness

There are many other ways to evaluate your broker’s responsiveness, but taking some of these steps is a good place to start: 1. Ask them for help with a few things, like for example, retrieving a lost password and username. 2. Then take note of how long it takes them to assist you and sort out the problem. 3. Deposit a small amount of money into your trading account. Request a withdrawal after a few days to see whether it is done as fast as the broker promised to do it. This will also give you the assurance that the forex broker actually allows clients to withdraw their funds (scammers often steal their client’s deposits). 4. Ask your broker to assist you with tasks like importing custom indicators, setting up charts, or running an account statement. Contact them via email and via their ‘live chat’ function if they have such a service. If you see that you need to wait a long time for assistance or if the representative doesn’t have the ability to help you properly, you definitely need to take note of this weaknesses. 5. Pay attention to how effective the broker’s communication is with its clients. Do they regularly notify their clients of important events or changes on their forex trading platforms? These events can include irregular trading hours due to holidays or changes in margin requirements.How to avoid choosing the wrong broker?

We all would like to find the best broker available and with all the fancy platforms, websites, and other promotions it's hard to decide which to choose.

For this reason, it's important to trust your intuition and common sense. If a broker looks too good to be true, then it's likely that he's not the one for you. It is easy to misjudge, so it helps to talk to other people who have been in the industry when trying to determine a broker with which to trade.

Checking reviews can help and there are many websites which offer extensive reviews. Besides the reviews, the feedback on websites can offer a lot of information. Familiarize yourself with the brokers reserved rights, to ensure you are making the correct choice.

Nonetheless, this information should always be taken with a grain of salt. Firstly, competition in the industry has pushed certain brokers to misuse broker feedback websites, leaving positive feedback for themselves while posting negative comments for their competitors.

Additionally, some traders blame the broker for their own trading mistakes and write negative reviews rather than conduct a post-trade self-analysis. For this reason, it is important to check a lot of feedback before choosing a broker.

You should conduct a thorough evaluation of all these factors to find a reliable firm and avoid choosing the wrong broker.

7 Best Forex Brokers have been explored and tested several prominent Forex brokers to identify the 7 best listed.

In this in-depth guide you’ll learn:- What constitutes the best Forex brokers?

- Who are the best Forex brokers?

- Best Forex Broker for Beginners.

- Regulated brokers list.

- Brokers with welcome bonus.

- Brokers with no deposit bonus.

- Brokers with the lowest spreads.

- Pros and cons of each broker.

- Popular FAQs about the best brokers.

7 Best Forex Brokers (2024*)

- ☑️AvaTrade - Overall Best Forex Broker.

- ☑️HFM - Best SA Forex broker regulated by FSCA.

- ☑️Exness - Low spread Forex Broker with low minimum deposit.

- FBS - Low Minimum Deposit Broker.

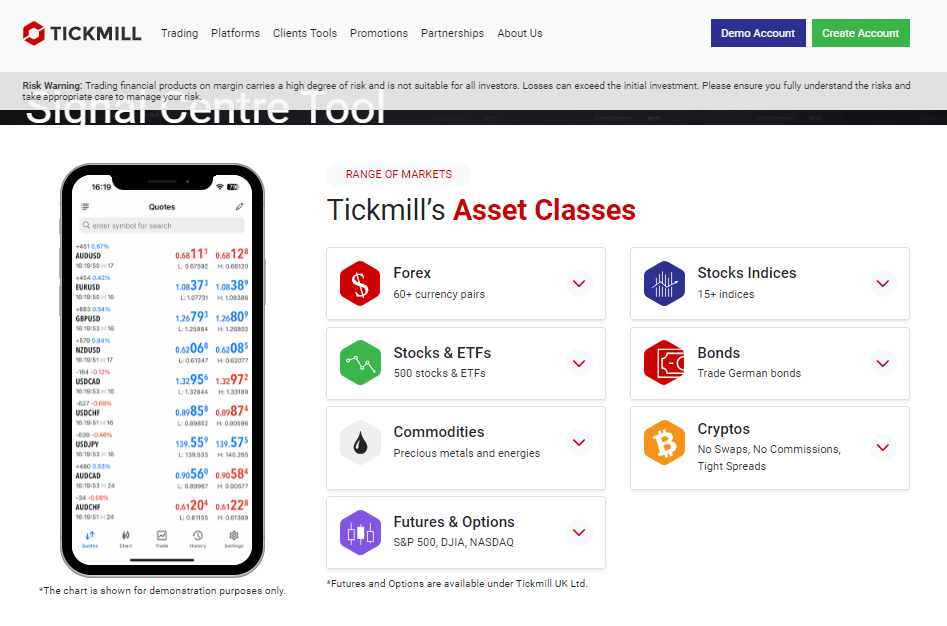

- Tickmill - Quality Educational Materials with no deposit bonus.

- BDSwiss - Good Option for Beginner Traders.

- IC Markets - Best Forex Platform for Professional Traders.

🏆 10 Best Forex Brokers

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | SFSA, FSCA, CySec* | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | Not Regulated | 0.001 BTC | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | SVGFSA | USD 5 | Visit Broker >> |

Who is the best Forex broker by criteria?

The best broker provides a user-friendly platform with low spreads, fast execution, and a wide range of currency pairs. They offer robust security measures, transparent pricing, and responsive customer support. Additionally, they provide educational resources, advanced trading tools, and a variety of account types to cater to diverse trading needs.The 7 Top Forex Brokers

| 👥 Brokers | 👉 Open Account | 💰 Minimum Deposit | ⚖️ Regulation | 💻Demo Account |

| AvaTrade | 👉 Open Account | USD $100 | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC | ✔️ |

| HFM | 👉 Open Account | USD $100 | FSP, FSCA | ✔️ |

| Exness | 👉 Open Account | USD $10 | CySEC, FSA | ✔️ |

| FBS | 👉 Open Account | USD $5 | FSA, FSCA | ✔️ |

| Tickmill | 👉 Open Account | USD $100 | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA, DFSA | ✔️ |

| IC Markets | 👉 Open Account | USD $200 | Authority of Seychelles (FSA) | ✔️ |

AvaTrade

Overview

AvaTrade stands out as one of the premier brokers due to its comprehensive range of features and services. Offering a user-friendly platform, it combines intuitive design with advanced tools for both novice and experienced traders. The Brokers competitive spreads, swift execution, and extensive selection of currency pairs ensure optimal trading conditions. Their commitment to security is evident through strong regulatory compliance and robust encryption protocols.

Moreover, their dedication to customer support, coupled with a wealth of educational resources, empowers traders to make informed decisions. These attributes collectively establish AvaTrade as a top-tier choice for Forex trading in the industry.

Their commitment to security is evident through strong regulatory compliance and robust encryption protocols.

Moreover, their dedication to customer support, coupled with a wealth of educational resources, empowers traders to make informed decisions. These attributes collectively establish AvaTrade as a top-tier choice for Forex trading in the industry.

Unique Features

| Feature | Information |

| 🏛️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA |

| 📲 Social Media Platforms | Instagram You Tube |

| 💻 Trading Accounts | Retail Account, Professional Account |

| 📊 Trading Platforms | AvaTradeGO AvaOptions AvaSocial MetaTrader 4 MetaTrader 5 DupliTrade ZuluTrade |

| 💰 Minimum Deposit | $100 |

| 📉 Trading Assets | Forex Stocks Commodities Cryptocurrencies Treasuries Bonds Indices Exchange-Traded Funds (ETFs) Options Contracts for Difference (CFDs) Precious Metals |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ✔️ Yes |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes (Dubai) |

| 👉 Open Account | 👉 Open Account |

AvaTrade Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade offers exotic forex pairs with ZAR | The educational materials are limited for more experienced traders |

| South Africans can register a ZAR-denominated account | AvaTrade’s full list of instruments is only available on MetaTrader 5 |

| AvaTrade is well-regulated and has a good reputation in South Africa | |

| Multilingual customer support is available |

Trust Score

AvaTrade has a high trust score of 96%.HFM

Overview

HFM distinguishes itself as a leading broker through a blend of innovative features and powerful trading tools. Boasting ultra-low spreads and lightning-fast execution, it ensures optimal trading conditions for investors of all levels. Their extensive range of currency pairs, commodities, and indices caters to diverse trading preferences. Their MetaTrader platform integration offers seamless access to advanced charting tools, technical indicators, and expert advisors. Furthermore, the inclusion of educational resources and market analysis enhances trader proficiency.

With multilingual customer support available 24/5, HFM prioritizes client satisfaction, making it a top choice for traders seeking reliability, transparency, and profitability in the Forex market.

Furthermore, the inclusion of educational resources and market analysis enhances trader proficiency.

With multilingual customer support available 24/5, HFM prioritizes client satisfaction, making it a top choice for traders seeking reliability, transparency, and profitability in the Forex market.

Unique Features

| Feature | Information |

| 🏛️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 📲 Social Media Platforms | Facebook Telegram YouTube |

| 💻 Trading Accounts | Micro Account, Premium Account, HFcopy Account, Zero Spread Account, Auto Account |

| 📊 Trading Platforms | MetaTrader 4 and MetaTrader 5 |

| 💰 Minimum Deposit | No minimum deposit requirement |

| 📉 Trading Assets | Forex, Precious Metals, Energies, Indices, Shares, Commodities, Cryptocurrencies, Bonds, Stocks DMA, ETFs |

| 💲 ZAR-based Account? | ✔️ Yes |

| 💲 ZAR Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ✔️ Yes |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes |

| FSCA Regulated | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

HFM Pros and Cons

| ✔️ Pros | ❌ Cons |

| A diverse range of account types cater to different traders | There is limited German-language help for local traders |

| Attractive bonus and promotion offer | Educational materials are not specifically suited for the German market |

| A diverse assortment of trading instruments | The withdrawal process might be enhanced for efficiency |

| Provides both MetaTrader 4 and MetaTrader 5 platforms | Spreads on certain accounts may not be as competitive |

| Multiple governments regulate the trading environment, assuring its security | The bonus system can be complicated and may not comply with local regulatory requirements |

Trust Score

HFM has a trust score of 85%.Exness

Overview

They emerge as a premier broker, distinguished by its exceptional features and services. Regulated by reputable authorities such as the FCA and CySEC, it assures traders of a secure and transparent trading environment. Offering ultra-low spreads starting from 0.0 pips, the broker facilitates cost-effective trading. Their diverse account types cater to various trading styles, including Standard, Pro, and Raw Spread accounts. The MT 4 and MetaTrader 5 platforms provide access to advanced trading tools, customizable interfaces, and automated trading capabilities.

With lightning-fast execution speeds and multilingual customer support, Exness delivers a seamless trading experience, earning its reputation as one of the best Forex brokers in the industry.

The MT 4 and MetaTrader 5 platforms provide access to advanced trading tools, customizable interfaces, and automated trading capabilities.

With lightning-fast execution speeds and multilingual customer support, Exness delivers a seamless trading experience, earning its reputation as one of the best Forex brokers in the industry.

Unique Features

| Feature | Information |

| 🏛️ Regulation | FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA |

| 📲 Social Media Platforms | LinkedIn YouTube |

| 💻 Trading Accounts | IG Trading Account Limited Risk Account Islamic Account (Dubai traders only) Demo Account |

| 📊 Trading Platforms | MetaTrader 4 IG Platform ProRealTime (PRT) L2 Dealer FIX API |

| 💰 Minimum Deposit | $250 |

| 📉 Trading Assets | Forex Indices Shares Commodities Cryptocurrencies Futures Options |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | No |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes (Dubai customers only) |

| 👉 Open Account | 👉 Open Account |

Exness Pros and Cons

| ✔️ Pros | ❌ Cons |

| Any trader can modify the leverage to suit their trading style and risk tolerance. | Exness operates in multiple regions, each with its own set of restrictions. |

| Traders can gain experience with virtual funds by demoing an account before investing in the live market. | Certain expert traders may believe that the platform's highly adjustable trading tools and capabilities are inferior to those of other specialty platforms. However, this represents a relatively small proportion of dealers. |

| Exness has been recognized for its practice of fully disclosing trading conditions, spreads, and fees. | While customer service representatives make every attempt to be always available, there may be variations in the timing and quality of their responses. |

| Exness does not impose any fees for withdrawals or deposits. | The possible intricacy and sophistication of the user interface may dissuade some traders from using it in comparison to their competitors. |

| There are options for depositing and withdrawing money locally. | Exness's sole focus on FX and CFDs may turn off potential investors searching for a more diverse range of investing opportunities. |

| Exness offers trading automation options to MetaTrader users, including Expert Advisors (EAs) designed specifically for Taiwanese clients. | Furthermore, having a lot of leverage increases the likelihood of substantial losses. |

| A diverse set of platforms and account types enable traders to trade across multiple markets. | Regardless of how deep the insights and market analysis are, some traders may consider they are inadequate. |

| Exness trades a variety of assets for its clients, including FX pairings, indices, cryptocurrencies, and commodities. |

Trust Score

Exness has a trust score of 97%.FBS

Overview

FBS stands out as a top-tier broker, offering a myriad of features that ensure a superior trading experience. Regulated by reputable authorities like CySEC and IFSC, FBS guarantees a secure trading environment. Their range of account options, including Cent, Standard, and ECN accounts, accommodates diverse trader needs. They excel in providing popular trading platforms such as MT 4 and MT 5, renowned for their advanced charting tools and seamless execution.

Furthermore, their multilingual customer support operates 24/7, offering assistance in various languages.

With competitive spreads and swift order execution, FBS is revered for its reliability, transparency, and client-centric approach in the Forex industry.

They excel in providing popular trading platforms such as MT 4 and MT 5, renowned for their advanced charting tools and seamless execution.

Furthermore, their multilingual customer support operates 24/7, offering assistance in various languages.

With competitive spreads and swift order execution, FBS is revered for its reliability, transparency, and client-centric approach in the Forex industry.

Unique Features

| Feature | Information |

| 🏛️Regulation | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA |

| 📱 Social Media Platforms | Facebook Twitter LinkedIn YouTube Instagram Telegram |

| 🔎 Trading Accounts | Pro Account, Classic Account, VIP Account |

| 💻 Trading Platforms | MetaTrader 4, MetaTrader 5 |

| 💸 Minimum Deposit | $5 |

| 🔁 Trading Assets | Forex, Stock Indices, Energies, Precious Metals, Bonds, Cryptocurrencies |

| 🚀 USD-based Account? | Yes |

| 💳 USD Deposits Allowed? | Yes |

| 💰 Bonuses for traders? | Yes |

| 📊 Minimum spread | From 0.0 pips |

| ✔️ Demo Account | Yes |

| ✔️ Islamic Account | Yes |

| 👉 Open Account | 👉Open Account |

FBS Pros and Cons

| ✔️ Pros | ❌ Cons |

| FBS offers localized customer support for traders in the United Arab Emirates, ensuring cultural and language alignment. | Enhancing features on the mobile app could provide a more comprehensive and efficient trading experience on mobile devices. |

| FBS provides a range of account types tailored to diverse trading preferences and experience levels. | Some users may find the platform's learning curve steeper, especially for those new to online trading. |

| FBS offers Islamic accounts, accommodating traders in the UAE who adhere to Islamic finance principles. | |

| FBS introduces unique promotions and bonuses, providing additional incentives and benefits for traders. |

Trust Score

FBS has a trust score of 75%.Tickmill

Overview

It is a leading broker renowned for its exceptional features and services. Regulated by top-tier authorities such as the FCA and CySEC, they ensure a secure trading environment. Offering various account types, including Classic, Pro, and VIP accounts, it caters to diverse trading needs. They provide access to cutting-edge trading platforms like MT 4 and MT 5, renowned for their advanced tools and lightning-fast execution.

Their multilingual customer support operates 24/5, offering assistance to traders worldwide. With competitive spreads, low commissions, and a commitment to transparency, Tickmill stands out as one of the best choices for Forex trading in the industry.

They provide access to cutting-edge trading platforms like MT 4 and MT 5, renowned for their advanced tools and lightning-fast execution.

Their multilingual customer support operates 24/5, offering assistance to traders worldwide. With competitive spreads, low commissions, and a commitment to transparency, Tickmill stands out as one of the best choices for Forex trading in the industry.

Unique Features

| 🏛️Regulation | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA |

| 📱 Social Media Platforms | Facebook, Twitter, LinkedIn, YouTube, Instagram, Telegram |

| 🔎 Trading Accounts | Pro Account, Classic Account, VIP Account |

| 💻 Trading Platforms | MetaTrader 4, MetaTrader 5 |

| 💸 Minimum Deposit | $5 |

| 🔁 Trading Assets | Forex, Stock Indices, Energies, Precious Metals, Bonds, Cryptocurrencies |

| 🚀 USD-based Account? | Yes |

| 💳 USD Deposits Allowed? | Yes |

| 💰 Bonuses for traders? | Yes |

| 📊 Minimum spread | From 0.0 pips |

| ✔️ Demo Account | Yes |

| ✔️ Islamic Account | Yes |

| 👉 Open Account | 👉Open Account |

Tickmill Pros and Cons

| ✅Pros | ❌Cons |

| Deposit and potentially withdraw funds using your mobile phone in select regions. | Mobile money support varies by country and provider. Check compatibility before relying on it. |

| Depending on your provider, deposits might be quicker and more convenient than traditional methods. | Double-check if your chosen provider allows both deposits and withdrawals. |

| Mobile money transactions might incur lower fees compared to some traditional methods, depending on your provider. | Minimum deposit amounts and processing times can vary based on your location and provider. |

| If unavailable or undesirable, mobile money offers an alternative deposit method. | Credit cards and bank transfers are generally more universally accepted by forex brokers. |

Trust Score

Tickmill has a trust score of 82%.BDSwiss

Overview

It distinguishes itself as a premier broker with a range of exceptional features. Regulated by reputable authorities such as CySEC and FSC, they ensure a secure trading environment. Offering a variety of account types, including Standard, Raw Spread, and VIP accounts, it caters to diverse trader needs. They provide access to cutting-edge trading platforms like MetaTrader 4 and MetaTrader 5, renowned for their advanced charting tools and seamless execution.

Their comprehensive educational resources, including webinars and tutorials, empower traders to enhance their skills and knowledge. With competitive spreads, swift order execution, and responsive customer support, BDSwiss is a top choice for Forex trading.

They provide access to cutting-edge trading platforms like MetaTrader 4 and MetaTrader 5, renowned for their advanced charting tools and seamless execution.

Their comprehensive educational resources, including webinars and tutorials, empower traders to enhance their skills and knowledge. With competitive spreads, swift order execution, and responsive customer support, BDSwiss is a top choice for Forex trading.

Unique Features

| Feature | Information |

| 🏛️ Regulation | FSCA, FSA, AMF, BAFIN, GFSC, CySEC, MAS, ASIC, FINMA, FSC |

| 📲 Social Media Platforms | Instagram You Tube |

| 💻 Trading Accounts | Cent, Classic, VIP, Zero Spread |

| 📊 Trading Platforms | BDSwiss WebTrader BDSwiss Mobile app MT4 Vs. MT5 MetaTrader 5 MetaTrader 4 |

| 💰 Minimum Deposit | ZAR R190 $10 |

| 📉 Trading Assets | Forex Shares Commodities Cryptocurrencies Indices |

| 💲ZAR-based Account? | No |

| 💲 ZAR Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for e traders? | ✔️ Yes |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

BDSwiss Pros and Cons

| ✔️ Pros | ❌ Cons |

| A wide variety of tradable items | Spreads are somewhat higher compared to competitors |

| Strong instructional content | Withdrawal costs might be off-putting |

| Advanced trading tools are provided | Account types are limited as compared to other brokers |

| The trading platform's UI is user-friendly | The research tools could be more extensive |

| Customer assistance is responsive | Premium services incur additional expenses |

Trust Score

BDSwiss has a high trust score of 90%.IC Markets

Overview

IC Markets stands out with its array of outstanding features in the Forex market. Renowned for its competitive trading conditions, IC Markets offers tight spreads starting from 0.0 pips, ensuring cost-effective trading. With various account types including Raw Spread, Standard, and True ECN accounts, traders can select options tailored to their preferences.

This, combined with lightning-fast execution speeds, robust regulation, and unparalleled customer support, solidifies IC Markets' position as a top-tier Forex broker.

With various account types including Raw Spread, Standard, and True ECN accounts, traders can select options tailored to their preferences.

This, combined with lightning-fast execution speeds, robust regulation, and unparalleled customer support, solidifies IC Markets' position as a top-tier Forex broker.

Unique Features

| Feature | Information |

| 🏛️ Regulation | ASIC, CySEC, FSA, SCB |

| 📲 Social Media Platforms | LinkedIn You Tube |

| 💻 Trading Accounts | cTrader Account, Raw Spread Account, Standard Account. |

| 📊 Trading Platforms | MetaTrader 4 MetaTrader 5 cTrader IC Social Signal Start Zulu Trade |

| 💰 Minimum Deposit | $200 |

| 📉 Trading Assets | Forex Indices Stocks Commodities Cryptocurrencies Bonds Futures |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | No |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

IC Markets Pros and Cons

| ✅Pros | ❌Cons |

| IC Markets is a popular broker regulated by several top entities globally | Leverage is capped according to the financial instruments |

| The trading conditions are competitive | There might be limitations on the availability of certain instruments |

| IC Markets is known for its robust and feature-rich technology and platforms | There is a rigorous and extensive verification process that could take some time to navigate |

| IC Markets offers extensive educational material and superior customer support |

Trust Score

IC Markets has a high trust score of 87%.